Hunger for growth

A new benchmarking study on growth in the global food and beverage industry offers optimism for manufacturers

Food and beverage companies around the world are now poised for growth. With recoveries well underway in the U.S., Japan, the U.K. and the Euro Zone, producers are once again investing in new markets, new products and new capacity. These findings, along with a number of other industry trends, are highlighted in Grant Thornton LLP’s recently released international food and beverage benchmarking study A Hunger for Growth: Food and beverage looks to the future.

The study comprised approximately 250 companies worldwide, with particular focus on North America, Europe and Australia/New Zealand. As you can imagine, with such an extensive study, there are numerous trends, issues and conclusions arising. When it gets right down to it, however, there are a few key messages to share.

Increasing optimism

The theme of growth was evident throughout the study. There is no question that producers around the world are optimistic. The vast majority, in all sectors of the industry, expects revenues and profits to increase this year; many are expecting double-digit growth. In addition, a significant portion expects employment in the industry to increase as well. With rapid advancement in logistics and technology, more and more producers believe they can meet customer demand almost anywhere. Although China and Southeast Asia are viewed as prime target markets for growth, many producers believe that significant growth opportunities exist in North America and Europe as well.

It was also clearly evident that producers believe they need to do their homework before embarking on these export strategies – meeting with local retailers, becoming aware of local regulations, gathering intelligence on local competitors and understanding tax compliance and planning opportunities were all identified as critical to successful export expansion.

Emerging trends also create significant growth opportunities. Producers must stay abreast of shifting consumer tastes, such as the trend towards healthier eating, or in some countries, the trend towards premium luxury products. Companies with agility, which are able to exploit these trends in the early stages with innovative new products, often profit most. Although larger companies might not be as agile, they are also able to exploit their networks and size to develop new products, leverage their established distribution channels and acquire other companies which may be further advanced in satisfying a particular trend. Regardless of size or agility, having the intelligence to recognize the trend, and the foresight to take advantage of it, are key.

Continued cost concerns

While there is definitely an air of optimism, the study also highlighted some accompanying concerns. In particular, many producers worry about rising costs, ever-increasing regulations, and supply-chain vulnerabilities. Almost two-thirds of the respondents indicated that they believe labour, transportation and materials costs will all continue to rise this year. Higher commodity prices are of particular concern, since materials typically comprise almost half of the cost of the end product. And with stringent food safety and supply chain traceability standards now in place around the world, navigating through the industry’s regulatory environment has become quite complex and costly. Producers in most parts of the world must now track their ingredients from farm to table, collaborating with partners throughout the supply chain to minimize financial, operational, legal and reputational liability that could harm their brands. Failure to comply with these standards can lead not only to regulatory sanctions, but also to major ramifications if tainted products reach the market. Interestingly, some of the more progressive producers actually view these regulations as opportunities to differentiate themselves by highlighting quality in their products, practices and supply chains

So, what should the results of the study mean to you? First, ensure that you have a growth strategy. Determine if you want to expand your existing operations internally or through mergers and acquisitions. If expanding existing operations, do you know which plants, which machinery and which technology? If you go down the M&A path, then conducting proper due diligence on your target companies and their markets is essential. In either case, you also need to make sure you can finance the expansion, so start laying the groundwork with your lenders today.

Second, innovate. Consumers want new products, improved quality and lower prices. Retailers want products that pull consumers into their stores and move products off their shelves, and concentrated power among retailers is here to stay. Strengthening your offerings to them gives you much more leverage should they try to become uncompromising.

Third, be aware of government regulation and assistance programs. With the increasingly complex worldwide regulatory environment, you must be able to monitor, measure and document your compliance with these regulations at home and abroad. In addition, make yourself aware, in whatever country you decide to operate in, of the government programs available to help you. Whether it’s tax-free zones, R&D incentives or the like, many good government programs exist and are available to help support your growth in their respective markets.

Finally, keep your ear to the ground. Local and global trends offer significant opportunities to grow. Stay current with these trends, evaluate which ones offer the greatest opportunity to you, and ensure you are in a position to take advantage of them when they arise.

To us, the most compelling message from the study is that food producers around the world are optimistic and excited. After years of uncertainty, retrenchment and delayed investments, the industry is in expansion mode once again. As a professional services firm, we are very proud to be able to serve companies in such a dynamic industry, and look forward to helping our clients satisfy their “hunger for growth.”

Jim Menzies, CA, is Global Food and Beverage industry leader for Grant Thornton LLP. For more information or to read the study in its entirety, visitwww.GrantThornton.ca/manufacturing

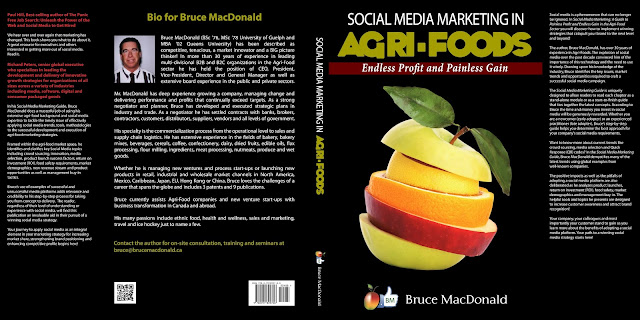

Check out my latest e-Check out my book entitled: "Social Media Marketing in Agri-Foods: Endless Profit and Painless Gain"

The book is available on Amazon and Kindle for $4.99 USD. Visit amazon/Kindle to order now:

http://www.amazon.ca/Social-Media-Marketing-Agri-Foods-ebook/dp/B00C42OB3E/ref=sr_1_1?s=digital-text&ie=UTF8&qid=1364756966&sr=1-1

Thanks for taking the time

No comments:

Post a Comment