EU trade pact details revealed as Conservatives table report in House of Commons

Adrian Wyld/The Canadian PressInternational Trade Minister Ed Fast says that allowing the EU to protect specific geographic terms for products was a tradeoff for other benefits to Canadians: “We believe that is a balance that was well worth achieving because it also allowed us to achieve some outcomes that we would not otherwise have achieved.”

OTTAWA — Canadian dairy producers have already expressed their anger over the federal government’s move to allow more cheese imports from Europe, but that may be just the tip of the gouda.

A report tabled Tuesday by the federal Conservative government in the House of Commons, explaining the final negotiated outcomes of the Canada-EU free-trade agreement, has shed more light on what is being billed as the largest and most wide-ranging free trade deal for Canada since NAFTA.

Among the details is an explanation of how the deal will affect 179 common food and beer names that are used by Canadian companies, but which the EU wanted protected because they are associated with specific geographic regions in the bloc.

While a full list wasn’t provided, the report shows such terms as Black Forest ham, Valencia orange and Bavarian beer will continue to be able to be used by Canadian producers in French and English.

It wasn’t clear the extent to which this new requirement may impact the Canadian dairy sector, or whether the new requirement will also apply to other products such as Asiago cheese bagels and Greek feta salad dressings.

Dairy Farmers of Canada spokeswoman Therese Beaulieu described the arrangement as “unfair” and warned it will negatively affect Canadian cheese producers trying to enter the market. Canadian dairy farmers were already upset about a doubling of EU access to Canada’s supply managed cheese sector.

“We’ve always believed that these are common names,” she said. “It’s not a flavour, it’s not imitation. It’s the real thing that’s being made by our cheese makers.”

But International Trade Minister Ed Fast said the protection of specific geographic terms for products was a key priority for the EU, and giving in on them meant Canada could make gains in other areas.

“The stakeholders knew what we were trying to achieve, and what we were trying to achieve was a balance,” he said in an interview. “We believe that is a balance that was well worth achieving because it also allowed us to achieve some outcomes that we would not otherwise have achieved.”

Canada has agreed to increase to $1.5 billion the threshold for reviewing foreign acquisitions of Canadian firms by European companies. All EU takeovers under $1.5 billion would not be subject to review under the Investment Canada Act to determine whether they’re of “net benefit” to Canada. The same threshold will apply to all countries with which Canada has free-trade agreements. While there will likely be concern in some corners about this, Fast said the move will likely attract more foreign investment into the country. “We think this is a good thing for Canada,” he said.

The deal also allows any party (Canada or EU and its members states) to terminate or withdraw from the agreement with six months notice, though Fast doesn’t anticipate the opt-out being used by either side. “We have no reason to expect that we will ever wish to terminate this agreement,” he said. “We don’t expect the EU would either because they stand to gain so much from this agreement.”

The following is a list of other details included in the report:

Eliminating duties: The agreement will eliminate 98 per cent of tariffs in the EU and Canada on the first day it takes effect, and eventually more than 99 per cent of them — including fully removing duties on all non-agricultural goods. The government expects eliminating the import taxes will lead to reduced prices on a wide range of consumer items coming from the EU, including clothing, perfumes, household products and automobiles.

Agriculture tariffs, including on beef and pork: Canadian farmers will receive yearly duty-free access into the EU for up to 50,000 tonnes of beef (including 70 per cent fresh, 30 per cent frozen), 80,000 tonnes of pork, and 3,000 tonnes of bison. An existing duty on a high-quality beef quota of 15,000 tonnes will also be removed, bringing total duty-free beef access to around 65,000 tonnes. Together, Canada and EU will liberalize about 93 per cent of tariff lines in agriculture.

Wines, spirits and specialty products: The EU is Canada’s main import source of wine, covering about half of the country’s imports. Tariffs will be eliminated and other trade barriers will also be removed, allowing improved access to the Canadian market for European wines and spirits. EU wines will still be sold through provincial liquor boards, but Canadian vintners can continue selling through their wineries. CETA will eliminate the eight-per-cent import tax on maple syrup going into the EU.

Supply management for dairy, eggs and poultry: Canada will more than double the amount of EU access into the Canadian cheese sector to around 30,000 tonnes annually. Canada will get unrestricted access to the EU’s dairy sector. Financial compensation will be provided to Canadian cheese producers adversely affected by the deal. Poultry and eggs are excluded entirely from CETA.

Automotive sector: Tariffs will be eliminated over seven years — including EU duties ranging from 3.5 per cent to 22 per cent, and averaging around 11 per cent — ultimately meaning reduced prices on vehicles coming from Europe, but also more competition for Canadian automobile manufacturers. Canada will eliminate 6.1-per-cent duty and recognize a list of EU car standards, making it easier for Europe to export cars here. The deal will allow for up to 100,000 passenger vehicles to be exported to Europe, compared to current average exports of 8,000 to 10,000 cars.

Government procurement: Many major Canadian cities asked for exemptions from CETA, worried it could limit their abilities to adopt “buy local” procurement policies. CETA rules will allow the EU to bid on contracts of $7.8 million or more for construction services, about $631,000 for procurement by utilities entities and approximately $315,000 or more for goods and services contracts. Canada will get greater access to Europe’s $2.7-trillion annual procurement market.

Canada has received a number of exemptions from the agreement, including health care and other public services; works of art and cultural industries for Quebec and all municipalities across Canada; research and development; shipbuilding and repair; sensitive goods procured by police forces and security agencies; and all major ports and airports.

Intellectual property (IP) protection: CETA will grant an additional two years of patent protection on brand-name drugs that face lengthy reviews, which could cost provinces potentially billions of dollars more for pharmaceuticals and delay access to cheaper generic drugs. The federal government will compensate provinces for the higher drug costs, although impacts are unlikely to be felt until 2023.

Sustainable development and environment: Provisions will “ensure” any increased economic activity resulting from CETA doesn’t occur at the expense of environmental protection. They allow for domestic “sanctions or remedies” for violations of environmental laws, although dispute resolution in this area does not include any enshrined penalties or trade sanctions in cases of non-compliance. Trade partners retain “right to regulate in the public interest,” including measures to protect the environment.

Fish and seafood products: Most import taxes will be cut. Canada will be forced to eliminate over three years minimum processing requirements on exports to the EU, a major concern to Newfoundland and Labrador, which had demanded fish and seafood caught in the province be processed there. Nearly 96 per cent of EU tariff lines for fish and seafood products will immediately be duty-free, and all tariff lines will be duty-free after seven years. Tariffs ranging from six to 20 per cent will be eliminated on products such as live and frozen lobster, peeled shrimp and frozen scallops.

Monopolies and state enterprises: Ensures monopolies and state enterprises operate in non-discriminatory manner, but nothing prevents both sides from designating or maintaining them.

Services and foreign investment: Governments retain the right to sovereign control over natural resources. Health care, public education, social services and culture are excluded.

CETA will create greater EU access to Canadian sectors such as financial services, telecommunications, energy and maritime transport. Fast noted in the interview that Canada has secured the best services agreement the EU has provided to any of its trading partners, including issues such as labour mobility, temporary entry, and mutual recognition of qualifications.

Uranium investment in Canada will be less restrictive, with the EU exempted from requirement of first finding a Canadian partner, although the Investment Canada Act still applies and “national security considerations protected.” Fast said the government worked closely with Saskatchewan, and Newfoundland and Labrador to help drive investment in their uranium sectors.

Dispute settlement and governance: The investor-state dispute settlement process allows for the early dismissal of “frivolous and stale claims” to ensure the process is not abused. It allows investors to sue the host state for breach of obligation and damages.

CETA would establish a state-to-state dispute settlement process, including three-person panels ruling on disputes. Specialized dispute settlement provisions will be created for the areas of financial services, taxation, labour and environment. The agreement will create a CETA Trade Committee that oversees the implementation of the agreement. Subcommittees will be created for various sectors included in CETA.

While this has been an area of concern for a number of groups, Fast said it will allow Canadian investors who feel aggrieved by the EU to seek redress. He added that the mechanism is built to ensure there are no “trivial” lawsuits that are more a nuisance than anything. “It does provide investors with additional assurance that when they make investments in Canada, their investments will be protected and will not be discriminated against,” he said. “That’s what investors are looking for; they’re looking for fairness.”

Labour mobility: The deal will establish mutual recognition of professional qualifications. CETA will make it easier for firms to move staff temporarily between the EU and Canada.

Exceptions from CETA: Exceptions for measures related to cultural industries (such as books, movies, television, music, performing and visual arts) are included in the agreement. Exceptions are also included on taxation policies, conservation of natural resources, and measures taken to protect national security. Water “in its natural state” is not a good or product and will not be subject to CETA.

Postmedia News

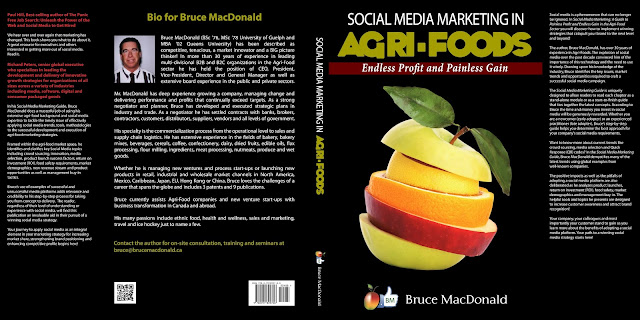

The book is available on Amazon and Kindle for $4.99 USD. Visit amazon/Kindle to order now:

http://www.amazon.ca/Social-Media-Marketing-Agri-Foods-ebook/dp/B00C42OB3E/ref=sr_1_1?s=digital-text&ie=UTF8&qid=1364756966&sr=1-1

Thanks for taking the time

No comments:

Post a Comment