HOW TO ENTER EMERGING MARKETS - PART 4 FROM AN ENTREPRENEUR"S PERSPECTIVE

Written by Bruce MacDonald6. Cross promote for better results. One billion cans of Pepsi rolled out in May 2012 plastered with a most unlikely ingredient: Michael Jackson's silhouette.

Pepsi

is tried once again to breathe serious life into the deceased King of

Pop's global image in a move that has left some marketing experts

aghast and others applauding. UTube Link to Pepsi Commercial and or photo of MJ

holding a Pepsi Can p. 35

The

unexpected marketing announcement comes on the heels of a new, global

partnership between Pepsi and the estate of Michael Jackson. Pepsi has lost global market share to rival

Coke the past year and is eager to grab some back with what it bills as a 25th

anniversary celebration of Jackson's multiplatinum Bad album and

tour. Only time will tell the success of

the campaign.

7. Tailor your product to the market you want

to sell in. By customizing Oreos to suit local

tastes, Kraft Foods expects $1 billion in sales of the iconic cookies from

markets such as China by 2013

Kraft has tailored the cookie’s marketing to better resonate among local consumers. In one Chinese commercial, a child gives a lesson in dunking (cookies, not basketballs) to former Houston Rockets star Yao Ming. In a South Korean ad, a baby clutches an Oreo while nursing at its mother’s breast. Kraft says that spot was made by its ad agency only for an awards program. However it's gone viral since its leak online.

Success outside mature developed markets is important for Kraft as it prepares for a spinoff of its snacks business later this year. Given unexciting prospects in the U.S., the new company, which will be called Mondelez International, will focus heavily on emerging markets.

Oreos haven’t always been popular outside the U.S. Kraft struggled for years in China, for instance, and considered leaving five years ago. The cookie “was spectacularly underperforming,” says Sanjay Khosla, Kraft’s president of developing markets. One problem: Kraft offered Chinese consumers the same type of Oreos that it sold in the U.S. “There was a belief that what was good for the U.S. was good for the world,” Khosla says.

After surveys showed that Chinese consumers found Oreos too sweet, Kraft put Andrade to work coming up with a new formula to better suit local tastes. In India, Kraft encountered the opposite problem: The American-style cookie was too bitter, Indians told researchers. Adjusting for local preferences “isn’t a matter of just removing one ingredient,” says Andrade. “It’s about making sure you balance the flavors. You almost have to reconstruct the product.”

For Asia, Kraft also decided to jettison many of its dozens of brands and instead concentrate on a few important ones such as Oreo and Tang. That simplification strategy makes sense in China, where many multinationals are trying to introduce their brands to middle-class consumers, says James Roy, a senior analyst with China Market Research Group in Shanghai. “There’s too much noise in terms of how many brands there are,” he says. “Those brands don’t have a history in China, and people get confused if you introduce too many things at once.

Kraft is trying the same approach in

India. The company acquired Cadbury in 2010 and the following year started

putting that name on Oreos in India, taking advantage of Cadbury’s well-known

brand and extensive distribution network there.

8. The government can be your partner. There are many funding programs available in Canada and the US, cost

sharing or tax incentives that can help you offset the huge costs of entering a

market. There are numerous companies

designed to attract funding. For

example, INAC Services Ltd. is one of Canada's top funding source firms assisting

numerous clients in obtaining grants and interest free loans for export

marketing, plant expansion, energy reduction, product development, R&D,

employee training, human resource development and much more

9. There are angels out there. Venture Capitalists are privately-owned corporate finance firms serving business owners needing access to sophisticated corporate financial services. Instead of taking a year to find money, with your eye off the ball and giving many often demoralizing presentations to inappropriate investors; you could outsource your financing needs to Venture capitalists or Private Equity firms. They can match your company with the best investors at the right price, and all of this within a far shorter time frame. Their focus is on high-growth firms that require any of the following services: Equity, Debt, and Mezzanine private placements; Growth financings; Management buy-outs; Recapitalizations; Strategic acquisitions; or Family business advisory services.

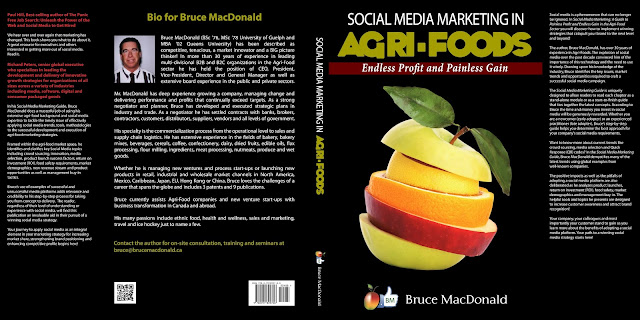

Check out my latest e-book entitled: "Social Media Marketing in Agri-Foods: Endless Profit and Painless Gain"

The book is available on Amazon and Kindle for $4.99 USD. Visit amazon/Kindle to order now:

http://www.amazon.ca/Social-Media-Marketing-Agri-Foods-ebook/dp/B00C42OB3E/ref=sr_1_1?s=digital-text&ie=UTF8&qid=1364756966&sr=1-1

Thanks for taking the time!

No comments:

Post a Comment