Australia and Canada: Two resource-driven economies on divergent paths Add to ...RICHARD BLACKWELL

The Globe and Mail

Published

Last updated

Australia’s central bank has cut its key interest rate again, to a record low, underscoring concern that a global commodity slump and slower growth in China will weaken its resource-based economy.

The country is trying to kick start consumer and business spending with the cuts because the mining sector has peaked and capital spending in that industry is falling, while economic growth posted by the country’s key trading partner, China, is slowing.

- Still, there are enough differences between the two countries, economists say, to insulate Canada from the economic turbulence facing our antipodal cousin.That’s a cautionary tale for Canada, which has a similar resource-based economy, dependent on exports. Weaker commodity prices help to explain, for example, a near-one-third drop this year in the share price of Vancouver-based Teck Resources Ltd., which ships about 15 to 20 per cent of its coking coal output to China.

For one, interest rates are at entirely different levels in the two countries. While the Bank of Canada’s key rate remains at 1 per cent, the cut in Australia takes its rate to a record low of 2.5 per cent. Australia never made the deep rate cuts that Canada and the U.S. implemented because its economy was not hit as badly during the global financial crisis that started in 2008.

In a sharp reversal of fortune, the buffer that shielded Australia during the “Great Recession” – easy credit in China that kept construction in the country booming during the global downturn – is vanishing.

“Australia is coming at this from a very different starting point than Canada,” said Doug Porter, chief economist at BMO Nesbitt Burns, who noted that the latest cut by the Reserve Bank of Australia is yet another in a long series that began more than a year and a half ago.

That highlights another key difference between the two countries, Mr. Porter said. “Australia is much more directly dependent on China than Canada is.” Despite having a smaller economy, Australia exports more than $70-billion (Australian) worth of goods to China each year, more than triple what Canada sends to the Asian country, which has the world’s second-largest economy.

At this point, Canada’s long-standing link to the U.S. economy is a huge advantage, Mr. Porter said, because “the U.S. looks as if it will soon start gathering momentum” from an economic perspective, just as China is cooling.

At the same time, the nature of Australia’s and Canada’s commodity exports differ significantly. Australia is very dependent on exports of iron ore and coal. These products account for almost 40 per cent of its total exports, and more than 60 per cent of its exports to China. Consequently, Australia’s economy has developed in recent years around capital spending in the mining industry.

Canadian commodity exports, by contrast, are much more heavily weighted to energy products such as oil and gas. Of our exports, more than 20 per cent are energy-related, while under 5 per cent are represented by coal and metal ores.

And fortunately for Canada, oil prices are showing some strengthening, a big contrast to the weak metals prices denting Australia’s economic prospects.

As a result, “the Canadian outlook is actually more positive than the Australian one,” said David Doyle, North American economist and Canadian strategist for Macquarie Securities Group. “We probably don’t face the same headwinds here as they do in Australia.”

He said the slowing Chinese economy is a long-term phenomenon, and the Australians in particular are going to have to deal with it – and its effect on metals prices – for some time. “If we look toward 2015-2016, China’s days of 8- to 10-per-cent growth are probably a thing of the past. It is up to financial markets to get used to an era of 6- or 7-per-cent growth out of China … [and] that growth is probably going to continue decelerating for the better part of this decade.”

At the same time, the pick-up in the economies of the United States and Europe should boost energy prices, which is good news for Canada, and is more than enough to offset the impact of the weakness in metals prices on our economy, he said.

Mr. Doyle also noted that Australia and Canada are in very different positions when it comes to consumer debt and housing, and that also has an impact on the way they manage interest rates. Australian consumers have paid back a lot of debt over the past few years, he said, giving the government there room to cut rates without risking the over-leverage that is a concern to the Canadian government.

The Australian government, which will face an election in early September, has presented some dismal forecasts recently, reinforcing their decision to trim rates.

Last week, the Australian finance ministry cut its forecast for economic growth in the current fiscal year to 2.5 per cent from 2.75 per cent. It also increased its projection for unemployment to 6.25 per cent from 5.75 per cent, and almost doubled the forecast for the budget deficit to $30.1-billion (Australian).

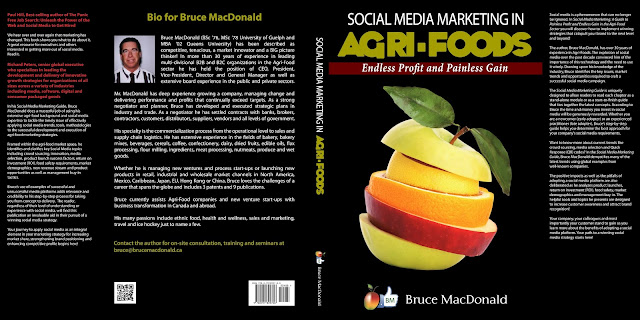

Check out my latest e-book entitled: "Social Media Marketing in Agri-Foods: Endless Profit and Painless Gain"

The book is available on Amazon and Kindle for $4.99 USD. Visit amazon/Kindle to order now:

http://www.amazon.ca/Social-Media-Marketing-Agri-Foods-ebook/dp/B00C42OB3E/ref=sr_1_1?s=digital-text&ie=UTF8&qid=1364756966&sr=1-1

Thanks for taking the time!

No comments:

Post a Comment