HOW TO ENTER EMERGING MARKETS - PART 1 FROM A BANK'S POINT OF VIEW

Five things I’ve learned about expanding into emerging markets

1. It is going to be different. So you have to make sure that it fits your own strategy and your own competencies. Do you have an advantage that will work in that marketplace? That means you’ve got to get on an airplane and go see what’s going on, and talk to a lot of local people.

1. It is going to be different. So you have to make sure that it fits your own strategy and your own competencies. Do you have an advantage that will work in that marketplace? That means you’ve got to get on an airplane and go see what’s going on, and talk to a lot of local people.

2. We don’t fly in and fly out. We think globally, but we’re local. In most of the countries we’re in, we’ve got local people on the ground. You have to match your products and your services to those very unique local needs.

3. In many of the new countries we go into, we start with a partnership, and that’s proven very useful in early stages—whether you look at Peru, Chile, Mexico, Thailand or, currently, Colombia. Your ability to execute and grow is much enhanced, because eventually you’ve got to develop local management, you’ve got to understand the distribution channels—all of those things that go into running that particular business. And you have to make sure that your people in head office here in Canada are on the same page as the people locally.

4. The Canadian brand is as strong as I’ve seen it in the 25 to 30 years I’ve been involved in the international world. So the windows are open. It’s a result, obviously, of our great economic performance, of our financial sector being strong, and it’s also a result of our competition. Whatever industry you are in, the European and American companies are really focusing on their problems at home rather than abroad. Well, that’s the window of opportunity. And we have a strong Canadian dollar, and we should use that to our advantage.

5. This great move toward globalizing and standardizing the regulatory regimes is very fraught right now. Everybody’s looking after their own backyard, despite what they signed off on in Pittsburgh, with the G20 and the Financial Standards Board and all those mandates. Actual on-the-ground regulation, by legislation, by political leadership, and even how the regulators are responding—it’s going in the opposite direction. And quite frankly, I don’t see that changing for a while.

-Grant Robertson

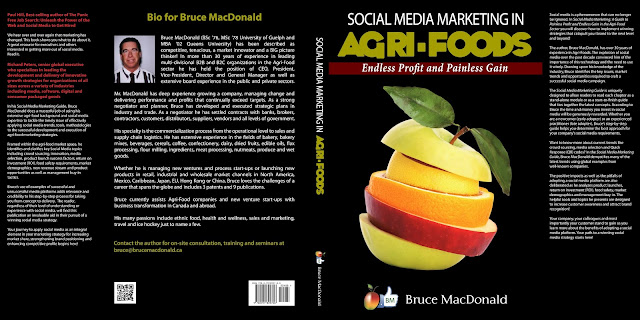

Check out my latest e-book entitled: "Social Media Marketing in Agri-Foods: Endless Profit and Painless Gain"

The book is available on Amazon and Kindle for $4.99 USD. Visit amazon/Kindle to order now:

http://www.amazon.ca/Social-Media-Marketing-Agri-Foods-ebook/dp/B00C42OB3E/ref=sr_1_1?s=digital-text&ie=UTF8&qid=1364756966&sr=1-1

Thanks for taking the time!

No comments:

Post a Comment