US Trade Forecast Report - HSBC Global Connections

The U.S. is one of the largest and most dynamic economies in the world. With a population of over 300 million people, the U.S. is a prime destination for investment by foreign companies.

The USA’s economy has experienced steady growth since 2010. This growth is being driven partly by consumers, which is feeding through to consumer goods imports. Firms are also investing and expanding capacity. Industrial machinery and transport equipment dominate exports and the country’s geographical position provides good access to the fastest growing markets in the global economy.

- Conditions are expected to improve rapidly over the next six months, with HSBC Trade Confidence Index jumping seven points to 114.

- USA’s competitiveness in transport equipment and industrial machinery gives exporters an advantage in the growing market for infrastructure goods.

- China’s rapidly growing economy will become an increasingly important market for USA exports, but Latin America will remain the most important consumer of the USA’s exports in the long-term.

| Rank | 2011 | 2030 |

|---|---|---|

| 1 | Canada | Canada |

| 2 | Mexico | China |

| 3 | China | Mexico |

| 4 | Japan | Brazil |

| 5 | UK | India |

Forecast data modelled by Oxford Economics, based on HSBC Global Research macro data. *The table considers goods exports between the 23 countries in the sample.

Conditions are improving for USA importers and exporters, with 67% of survey respondents expecting volumes to rise over the next six months. This will be driven by improving domestic conditions and the rapid pace of expansion in emerging markets, despite the recent slowdown.

Equipping for growth

Why infrastructure is important

Infrastructure is vital for achieving and maintaining a high level of economic development. As an exporter, the USA benefits from growing demand in emerging markets, but it is also a significant importer of infrastructure goods.

The USA is a leading exporter of industrial machinery and transport equipment. It stands to benefit from rising global demand for infrastructure goods, particularly from emerging markets.

China will become an increasingly important market. Exports of transport goods to China is forecast to rise by over 10% pa until the 2030s.

The USA will also be an important source of demand for infrastructure goods, with industrial machinery, ICT equipment and transport equipment accounting for over half of the growth in imports in the long-term.

As a result the USA is highly ranked for both intermediate infrastructure goods and industrial machinery within our sample.

Equipping for growth (% year Growth 2013-30)

“The investment countries are making in infrastructure is phenomenal and provides a huge opportunity for businesses looking to grow and develop.Rising middle classes across Asia’s rapidly emerging markets will drive significant infrastructure demand in the region. As China looks to scale the value chain in terms of the goods it manufactures, there is a strong opportunity for developed economies to supply sophisticated investment equipment to the country’s producers.We expect infrastructure-related goods to increase their share of rising global trade, providing strong opportunities across both developed and emerging economies for exporters and importers of those goods and the merchandise that can be manufactured as a result.”

James Emmett, HSBC Global Head of Trade and Receivables Finance

Short-term snapshot

Trade flows should accelerate in the short-term, with 67% of respondents expecting trade volumes to rise over the next six months (up from 48.3% in H2 2012). The key driver of this rise is an expected improvement in global economic conditions, with 29% of respondents citing this as the main reason for increasing business.

HSBC Trade Confidence Index

The acceleration of growth in the USA and the impact this is having on the global economy is evident in the HSBC TCI. The Index has jumped up to 114 (from 107 previously), the highest level ever recorded. At the sectoral level, wholesale/retail companies are most optimistic about the outlook, which reflects the expected acceleration in private sector spending.

Cross border business

Although growth in emerging markets has slowed in recent months, they will still support an expansion of trade, with 20% of respondents citing Latin America and 13% choosing Greater China as the most promising regions for trade in the short-term.

Region to region trade

Corridors of choice

- The USA has good access to a wide range of export markets because of its geographical position, openness to trade and competitiveness. More than 50% of respondents report trading with Latin America, Greater China, the rest of Asia, Canada and Europe.

- Although Canada is the country’s largest export market, Greater China and Latin America are seen as the key growth markets over the next six months.

- Man-made goods (including infrastructure goods) are a key export and import into the USA, with around 75% of firms dealing in the trade of semi-finished/finished goods.

- Unlike other countries, currency volatility is not an issue for USA traders. Instead, the cost of essential services (shipping, logistics and storage) is the most common barrier to import and export growth.

Opportunities for business

Firms are well-placed to take advantage of demand for the infrastructure goods needed for economic development. They have good access to all the world’s fastest growing markets. Looking ahead, robust growth in Greater China and Latin America will result in these regions becoming increasingly important markets for USA businesses.

Long-term outlook

As the world’s largest economy, the USA has historically been a driver of global economics trends, and is forecast to grow around 6% pa on average over the period 2013-30. This remains the case today, with accelerating demand in the USA set to trickle down to other countries via trade flows. But the recent slowdown in emerging markets will have an impact on demand for USA exports, although these markets are expected to be a source of growth over the longer-term.

Corridors to watch

The USA’s nearest neighbours, Canada and Mexico, are currently its most important export markets, accounting for 19% and 14% of exports respectively. Although Canada’s importance will diminish over time as emerging market demand increases, it will still account for 17% of exports in 2030, while Mexico’s share will remain constant over the next three decades.

The fastest growing market will be China. The country’s share of USA exports will more than double over the next thirty years, from 7% today to 18% in 2040. In contrast, the importance of Europe as a source of demand will fall, with the region’s share dropping to 13% in 2030 from 20% in 2012.

At a sectoral level USA exports are driven by industrial machinery and transport equipment, which will together account for 35% of the growth in exports over the next three years. Industrial machinery is also a large component of imports, but the USA will continue to import significant amounts of ICT and transport equipment, petroleum products, clothing and apparel.

Sector contribution to increase in merchandise exports

Focus on infrastructure

- The USA is well-placed to take advantage of developing economies’ demand for infrastructure goods. Its top two export sectors (in terms of contributions to growth) are industrial machinery and transport equipment, which directly supply the goods needed for countries to develop their infrastructure and for companies to build up capital stocks.

- As a result, the USA scores highly on our goods for infrastructure and investment equipment rankings (third and second respectively), although this position is challenged over the forecast horizon.

- The USA will also remain a significant consumer of infrastructure and investment goods from abroad given its need to renew and replace the country’s existing capital stock.

Conclusion

Although the USA will face increasing competition from emerging markets over time, the rapid development of these countries will also bring new opportunities for trade. Those in China are well-known, but Latin America will also become a key market over the next thirty years.

About the HSBC Global Connections Report — Modelled by Oxford Economics:

Oxford Economics has tailored a unique service for HSBC which forecasts bilateral trade for total exports/imports of goods, based on HSBC’s own analysis and forecasts of the world economy, to generate a full bilateral set of trade flows for total imports and exports of goods and balances between 180 pairs of countries. Oxford Economics produces a global report for HSBC, plus regional reports and country specific reports on the following 23 countries: Hong Kong, China, Australia, Indonesia, Malaysia, India, Singapore, Vietnam, Bangladesh, Canada, USA, Brazil, Mexico, Argentina, UK, France, Turkey, Germany, Poland, Ireland, UAE, Saudi Arabia, and Egypt.

Oxford Economics employs a global modelling framework that ensures full consistency between all economies, in part driven by trade linkages. The forecasts take into account factors such as the rate of demand growth in the destination market and the exporter’s competitiveness. Exports, imports and trade balances are identified with both historical estimates and forecasts for the periods 2013 15, 2016 20 and 2021 30.

The model looks at two-digit classifications from the COMTRADE database, grouped into a set of thirty headings. The sector data has been tracked by country, to give an insight into the primary drivers of trade between the 25 countries and territories in the sample. The sector data has been calculated to show growth as a percentage of the overall contribution to growth, to ensure that the model highlights the sectors which are representing the biggest drivers of growth. More information about the sector modelling can be found on: www.globalconnections.hsbc.com

Oxford Economics formerly Oxford Economic Forecasting was founded in 1981 to provide independent forecasting and analysis, tailored to the needs of economists and planners in government and business. It is now one of the world’s leading providers of economic analysis, advice and models, with over 500 clients. Oxford Economics commands a high degree of professional and technical expertise, both in its own staff of over 70 professionals based in Oxford, London, Belfast, Paris, UAE, Singapore, Philadelphia and New York, and through its close links with Oxford University and a range of partner institutions in Europe and the USA.

About the HSBC Trade Confidence Index:

The HSBC Trade Confidence Index is conducted by TNS on behalf of HSBC in a total of 20 markets, and is the largest trade confidence survey globally. The current survey comprises six-month views of 5,800 exporters, importers and traders from small and mid-market enterprises on: trade volume, buyer and supplier risks, the need for trade finance, access to trade finance and the impact of foreign exchange on their businesses. The fieldwork for the current survey was conducted between May June 2013 and gauges sentiment and expectations on trade activity and business growth in the next six months.

Equipping for growth Methodology:

This report looks at the key industry sectors that contribute to an economy’s productive capacity. This will include not only trade in the intermediate goods required for infrastructure projects, but also trade in the investment equipment required by businesses to boost production.

It collects key investment-related sub-sectors into two groups, defined as “intermediate goods for infrastructure” and “investment equipment”. As the sectoral trade forecasts are based on the UN’s Standard International Trade Classifications at the two-digit level, this does present some issues in accurately defining the sub-sectors that contribute to investment, due to broad sectoral definitions.

Intermediate goods for infrastructure:

66 Non-metallic mineral manufactures

67 Iron and steel

68 Non-ferrous metals

69 Manufactures of metals

76 Telecoms equipment

81 Prefabricated buildings

79 Other transport equipment

Investment equipment:

71 Power-generating machinery and equipment

72 Machinery specialised for particular industries

73 Metalworking machinery

74 General industrial machinery and equipment

75 Office machines and automatic data-processing machines

77 Electrical machinery, apparatus and appliances

87 Professional and scientific instruments

Based on the same underlying forecasts used for the existing analysis of trends in bilateral trade flows, the report examines how exports/imports of these two aggregates are expected to evolve over time. The import forecasts for these aggregates will be linked to the underlying investment requirements of the economy, while the export forecasts will be linked to the economy’s ability to produce the investment goods required by other nations.

This document is issued by HSBC Bank plc. It is not intended as an offer or solicitation for business to anyone in any jurisdiction. It is not intended for distribution to anyone located in or resident in jurisdictions which restrict the distribution of this document. It shall not be copied, reproduced, transmitted or further distributed by any recipient. The information contained in this document is of a general nature only. It is not meant to be comprehensive and does not constitute financial, legal, tax or other professional advice. The views and opinions expressed by contributors are their own and not necessarily those of HSBC Bank plc. Under no circumstances will HSBC Bank plc or the contributors be liable for any loss caused by reliance on any opinion or statement made in this document.

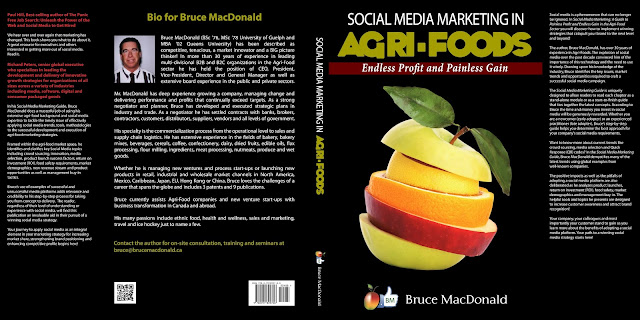

Check out my new e-book entitled: "Social Media Marketing in Agri-Foods: Endless Profit and Painless Gain"

The book is available on Amazon and Kindle for $4.99 USD. Visit amazon/Kindle to order now:

http://www.amazon.ca/Social-Media-Marketing-Agri-Foods-ebook/dp/B00C42OB3E/ref=sr_1_1?s=digital-text&ie=UTF8&qid=1364756966&sr=1-1

Thanks for taking the time

No comments:

Post a Comment