China announced Wednesday it has fined six milk suppliers, including Mead Johnson and New Zealand’s Fonterra, a total of $108-million for price-fixing after an investigation that shook the country’s fast-growing dairy market.

The announcement came as China reels from a separate recall of milk supplies from Fonterra this week due to possible contamination.

The investigation reflected intensifying scrutiny of business under China’s 5-year-old anti-monopoly law. Most targets so far have been foreign-owned. It was carried out against the backdrop of Chinese probes of possible bribery and other misconduct by global suppliers of pharmaceuticals and other products.

Anti-monopoly enforcement “is getting more and more forceful,” said Wang Xiang, a lawyer for the firm Orrick, Herrington & Sutcliffe.

The Cabinet’s National Development and Reform Commission said it imposed fines totalling 668.7 million yuan ($108-million U.S.) on the local units of Mead Johnson Nutrition Co., based in Glenview, Illinois; Hong Kong-based Biostime International Holdings Ltd.; Dumex, a unit of France’s Danone SA; Abbott Laboratories, in Abbott Park, Illinois; Fonterra Co-operative Group and Dutch-based FrieslandCampina NV.

The companies admitted they violated the anti-monopoly law by setting minimum prices distributors were required to charge, which raised costs for consumers, the NDRC said in a statement. Regulators did not allege direct collusion, known as horizontal price-fixing, among them.

Setting minimum prices is a common practice in some markets, where companies want to maintain an image as a premium brand. But lawyers say Chinese regulators appear to see most such requirements for distributors as illegal.

Last week, health care giant Johnson & Johnson was ordered by a Shanghai court to pay compensation to a former distributor in a lawsuit brought under the anti-monopoly law.

Beijing is especially concerned about consumer prices at a time when communist leaders face pressure to contain surging living costs.

Three suppliers were found to have violated the law but were spared fines, the NDRC statement said. They were China’s Beingmate Group Ltd.; Wyeth Nutrition, a unit of Switzerland’s Nestle SA, and Japan’s Meiji Dairies Corp.

Other industries also could face tougher scrutiny, especially those in which foreign enterprises have advanced technology that might dominate a market, said Wang.

“Industries like new drugs and medical equipment, especially top companies that have the potential to be monopolies, should pay more attention to this,” he said.

Milk and its quality and price are sensitive in China after six babies died and thousands were sickened in 2008 due to formula tainted with the chemical melamine. That prompted many parents to switch to buying more expensive imported milk.

Thursday’s announcement referred to suppliers of milk powder while earlier reports by state media said investigators specifically targeted sellers of powdered infant formula.

Milk suppliers including Nestle and Dutch-based FrieslandCampina announced price cuts of 5 to 12 per cent after the investigation was launched.

Mead Johnson was fined 203.8 million yuan ($33-million), Biostime 162.9 million yuan ($26.3-million) and Dumex 172 million yuan ($27.7-million), according to the NDRC statement. FrieslandCampina was fined 48.2 million yuan ($7.8-million), Abbott 77.3 million yuan ($12.5-million) and Fonterra 4.5 million yuan ($720,000).

Some fines were based on companies’ annual sales and ranged from 3 to 6 per cent of revenue, the agency said.

There have been few court rulings so far on the 2008 anti-monopoly law. That has fed uncertainty about how it will apply to global companies that are eager to expand in the world’s second-largest economy.

Chinese regulators have cited the law in ordering changes to acquisitions or business practices. In 2009, they blocked Coca-Cola Co. from buying a Chinese fruit juice producer.

Business groups welcomed the law as a step toward clarifying operating conditions in China. Since then, they have said it is enforced more actively against foreign companies than against their Chinese rivals.

Last week, a Shanghai court ordered U.S.-based health care giant Johnson & Johnson to pay damages to a distributor in a lawsuit filed under the anti-monopoly law. The court said J&J improperly set minimum prices, depriving the local distributor of possible sales.

Meanwhile, China has ordered a recall of Fonterra infant formula after the dairy company announced Saturday that hundreds of tons of infant formula, sports drinks and other products might be tainted with bacteria that could cause botulism.

Also last month, police detained four employees of GlaxoSmithKline on charges they bribed doctors to prescribe the British pharmaceutical giant’s drugs.

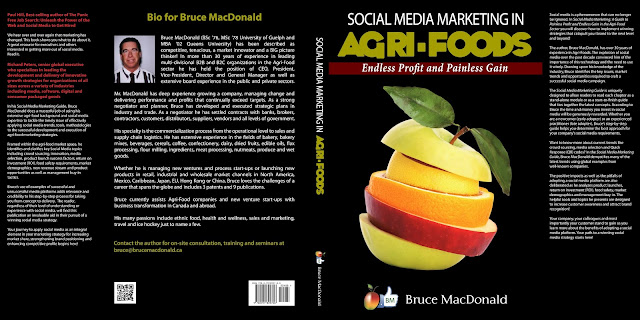

Check out my latest e-book entitled: "Social Media Marketing in Agri-Foods: Endless Profit and Painless Gain"

The book is available on Amazon and Kindle for $4.99 USD. Visit amazon/Kindle to order now:

http://www.amazon.ca/Social-Media-Marketing-Agri-Foods-ebook/dp/B00C42OB3E/ref=sr_1_1?s=digital-text&ie=UTF8&qid=1364756966&sr=1-1

Thanks for taking the time!