Will Amazon take over the supermarket?

With AmazonFresh, the online seller of basically everything wants to revolutionize the grocery business

Many of us born in the 1960s or before remember getting milk delivered to our homes twice a week. Even my family, owners of a group of supermarkets, used this service.

Gradually, however, shoppers began buying milk, eggs and other dairy from grocery stores, and the milkman began delivering to fewer homes.

At some point, perhaps when only 40% of a neighbourhood was buying from the milkman, it was no longer economically feasible for the dairy industry to continue this service.

Now think of this story in reverse. As more people buy groceries online, the economics of the model become feasible, especially in cities and suburbs. All of this is a long way to say that home delivery may now be more than just a solution looking for a problem.

This is what Amazon.com’s home-delivery grocery service, AmazonFresh, is counting on.

Amazon.com launched AmazonFresh, six years ago, in Mercer Island, a city of around 24,000 near the company’s headquarters, in Seattle. The service has since expanded to other areas of northwest Washington.

More recently, AmazonFresh arrived in Los Angeles, and it is rumoured the service will be in 20 markets next year, including, possibly, Vancouver.

In Canada, Amazon has sold books and more for years. But now the company appears keen to enter the grocery game.

Last month, Amazon.ca/grocery launched. The service delivers dry foods and beverages, but no fresh or frozen. Some 15,000 products are available, and Amazon promises two-day delivery.

But shipping parcels of coffee pods or cereal boxes is not the same as delivering milk, meat and celery to homes in person. That’s why AmazonFresh is a potential game-changer: the world’s largest and most sophisticated e-tailer going head-to- head with supermarkets for the weekly grocery shop.

To hear company officials explain it, Amazon is getting into groceries simply because consumers asked for it.

“We heard from our customers that there is a desire to shop for fresh food online. Testing AmazonFresh in Seattle and expanding into Los Angeles has given us the opportunity to be very thoughtful about our entry into the online grocery business,” says Amazon.com public relations spokesperson Katie McFadzean.

Experts suggest a different motive. AmazonFresh, they surmise, is a way for Amazon to connect with millions of shoppers more often.

Simply put, people buy food once or more a week. If they get used to buying groceries from Amazon, they might order higher-margin DVDs and e-readers, toys, housewares, video games and even bedding as well. In other words, grocery could allow Amazon to control a bigger portion of trips and sales across all of retail.

That’s in the future, of course. For now, AmazonFresh sells 10,000 grocery products along with a smattering of regular Amazon.com items in just Seattle and L.A. Consumers can either get their orders the same or the next day, depending on truck availability.

Recent reports give context to the rollout of AmazonFresh and its potential impact. RetailNet Group, a consulting firm based in Waltham, Mass., estimates AmazonFresh had US$66 million in sales in 2012, which is little more than a rounding error in the US$10 billion Seattle–Tacoma grocery market.

AmazonFresh isn’t even the largest delivery online grocer in the U.S. Peapod, a subsidiary of Dutch giant Ahold, sold $525 million worth of groceries in 2012 across seven states and the District of Columbia, according to RetailNet Group. Fresh Direct sold $407 million in New York City and Philadelphia, while Safeway’s e-commerce business sold $196 million.

But Amazon is investing in its grocery future. It has pumped more than US$100 million in a temperature-controlled delivery fleet and a specialized facility to store approximately 15,000 frozen, chilled and shelf-stable grocery SKUs.

RetailNet Group expects AmazonFresh to expand aggressively. It points to the company’s capital investments in its logistics network over the last 24 months. The firm also notes that in negotiations with vendors, Amazon is claiming the delivery service could roll out to as many as 40 American markets by the end of 2014.

One shocking advantage AmazonFresh has over rival grocers is that it doesn’t need to make money selling food.

Tom Furphy, former vice-president of AmazonFresh and consumables at Amazon, says his former employer already has many profitable revenue streams, so there’s little pressure to make a profit on new retail lines.

Amazon is able “to enter new businesses and price competitively, and can absorb losses thanks to these other profitable revenue streams,” says Furphy, now CEO of Consumer Equity Partners.

“They certainly don’t want to make a long-term commitment to a business in which they cannot make money. But they can afford to absorb losses while they perfect the model,” he explains.

All of this leads to the question of how grocers are responding to the launch of AmazonFresh, and what tactics can be deployed to compete with the service. While technology is critical, industry observers say it’s more important to meet the specific needs of the shopper.

One grocery executive in the Seattle area said his chain has been impacted more by Costco than Amazon. To retain customers from both rivals, he uses a marketing approach that includes a focus on fresh and prepared items, weekly flyers, store brands and a loyalty card.

The executive, who asked not to be identified because of competitive issues, says his private-label brand and prepared foods in particular help his stores present a clear difference to grocery shoppers.

Over the long run, AmazonFresh will expand and likely gain some consumer following. But dominance may prove elusive. As the Seattle market has shown, merely being “Amazon” is not enough to attract double-digit market share in grocery.

Nor is selling books online anywhere near as complex as selling pork loin. Amazon can beat up on Indigo and Best Buy because it doesn’t have to pay costly store rents and salaries.

Delivering food door-to-door, on the other hand, is labour intensive. It remains to be seen whether same- or even next- day grocery delivery can be made more efficient, and therefore cheaper, than more traditional supermarket models.

In Canada so far, Amazon’s grocery prices aren’t sending shoppers scrambling to the Internet. In early November, Amazon.ca was advertising a 400-gram box of Kellogg’s Vector cereal for $5.39. That was 90 cents cheaper than Toronto’s entrenched online grocer, Grocery Gateway. But it was $1.40 higher than Shoppers Drug Mart, which had a sale on Vector.

If and when online grocery shopping takes off, AmazonFresh will surely face stiff competition. In Canada, that’ll come from the Big Three grocers plus Walmart, which have considerable clout with suppliers as well as store fleets that could become pickup points should European-style click-and-collect grocery shopping emerge.

“Food retailers with an omni-channel presence will present a challenge to those like Amazon. So much so that I expect Amazon to consider bricks-and-mortar outlets along the lines of the Apple Store,” says Richard George, professor of food marketing at the Haub School of Business at Saint Joseph’s University in Philadelphia.

AmazonFresh may not be the bogeymen some analysts make it out to be. But it does have the backing of one of the world’s largest retailers, and so it can’t be written off.

Traditional grocers are advised to increase their engagement with shoppers and make shopping more customer-rather than product-focused. The difference is subtle, but important, and it could result in bolder supermarket experiences that keep customers coming into stores, rather than buying online.

George envisions a supermarket with “its current perimeter expanded and romanticized, similar to European street markets, with stalls of delicious fresh fruit and vegetables, with gourmet cheeses, artisan breads, fresh flowers, as well as today’s lunch or tonight’s dinner.”

Stores would also have drive-thrus in which pre-ordered groceries would be loaded into cars. That could prove a winning formula for existing supermarkets as AmazonFresh begins its march across cities.

Retired milkmen everywhere will be watching

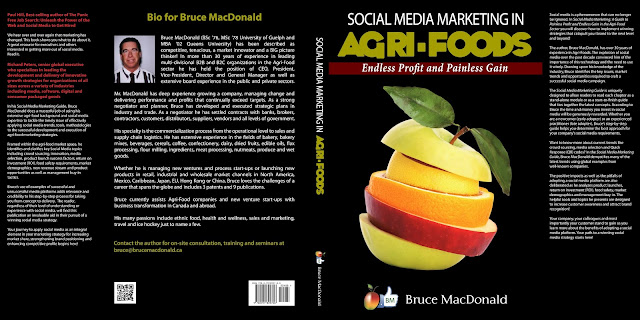

The book is available on Amazon and Kindle for $4.99 USD. Visit amazon/Kindle to order now:

http://www.amazon.ca/Social-Media-Marketing-Agri-Foods-ebook/dp/B00C42OB3E/ref=sr_1_1?s=digital-text&ie=UTF8&qid=1364756966&sr=1-1

Thanks for taking the time

The book is available on Amazon and Kindle for $4.99 USD. Visit amazon/Kindle to order now:

http://www.amazon.ca/Social-Media-Marketing-Agri-Foods-ebook/dp/B00C42OB3E/ref=sr_1_1?s=digital-text&ie=UTF8&qid=1364756966&sr=1-1

Thanks for taking the time

No comments:

Post a Comment