Grocers rush to open 'dark stores' as online food shopping expands

Supermarket chains including Tesco, Asda and Waitrose to sign up for twice as much warehouse space to meet internet sales

Waitrose will more than double the number of online delivery slots available when it opens its second dot.com fulfilment centre in south London. Photograph: David Pearson/Rex Features

Grocers are cutting back on megastores, but rising internet food sales will see supermarkets sign up for twice as much online warehouse space this year.

The major supermarkets – including Tesco, Asda and Waitrose – will this year commit to doubling the space devoted to internet distribution centres, known as dark stores, according to property agent Jones Lang LaSalle. Around 1.8m sq ft of warehouse space is devoted to dark stores, but that is set to increase as online shopping transforms the retail sector.

The internet is set to become a key battleground for the grocers in 2014 as Morrisons finally launches its online service in partnership with Ocadoon Friday and rival supermarkets vie to entice shoppers with services such as same-day delivery and convenient "click and collect" locations. Morrisons and Tesco were among the retailers who declared an end to the "race for space" last year after admitting that out-size stores had been caught out by the emergence of online shopping and smaller convenience stores.

Grocers' online services are thought to have played an important part in the tussle for customers over Christmas. As much as 15% of UK grocery sales, worth £900m, are anticipated to have been booked online in the four days from 20-23 December, according to analysts at Verdict, compared with an average of 5.5% throughout 2013. Verdict is predicting that 6% of grocery sales will be made online this year while the market is set to double in value over the next five years to £13bn, according to IGD, the grocery market research body.

The importance of internet stores for non-food retailers this Christmas has been underlined by John Lewis and Next, which both reported double digit rises in online stores over the festive season.

While the proportion of groceries sold online is much smaller than other sectors, the vast size of the food market means it is a key avenue of growth for under-pressure mainline supermarkets.Stuart Rose, chairman of Ocado, told the Guardian that the online grocery market had reached the "point of inflection". "The future for online food retail is very exciting. We are at the beginning of a revolution and the pace of change is accelerating. It's online showtime," he said.

Most supermarkets currently pick the vast majority of their online orders from stores. But growing competition and demands from shoppers have encouraged supermarkets to open dark stores which enable them to ensure better availability and a faster, more efficient service.

"Dark stores really bring availability up and make internet shopping a more viable option for a lot more shoppers than when goods are picked in store," said Andy Stevens, senior retail analyst at market research firm Verdict.Waitrose will more than double the number of online delivery slots available when it opens its second dot.com fulfilment centre in south London this autumn. Tesco is expected to open its seventh dark store in Didcot, Oxfordshire, later this year. The UK's biggest online grocer opened two dark stores in 2013 and has previously said it is scouting for further sites in Birmingham and Manchester. Its newest centre in Erith, south east London, can process 4,000 orders a day and offer 30,000 different items, 50% more than the average store. The site has also been designed to help Tesco launch same-day deliveries, a service already offered by Asda and Ocado.

Asda opened a dot.com distribution site in Nottingham last spring, adding to dark stores in Leeds and Enfield. Sainsbury's has said it will open its first dark store in Bromley-by-Bow, east London, "within the next few years".

Retailers are being forced to open the new dark stores because delivering to thousands of homes demands a completely different set up to transporting bulky loads to a few hundred stores. Jon Neale, UK head of research for Jones Lang LaSalle, which detailed the plans in its 2014 property predictions report, said the increase in demand for sites was not only driven by more people buying online but by the concentration of shoppers in particular areas.

"The growth of internet shopping is about the changing nature of demand. It is more pronounced among certain demographics and is not distributed evenly across the country," he said.

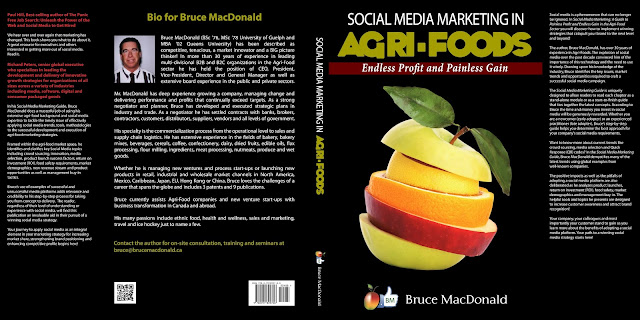

The book is available on Amazon and Kindle for $4.99 USD. Visit amazon/Kindle to order now:

http://www.amazon.ca/Social-Media-Marketing-Agri-Foods-ebook/dp/B00C42OB3E/ref=sr_1_1?s=digital-text&ie=UTF8&qid=1364756966&sr=1-1

Thanks for taking the time

No comments:

Post a Comment