5 TRENDS TO SPUR FOOD SERVICE GROWTH IN 2014

Posted in News, Market Research, Market Trends, Foodservice, Restaurant, Fast Casual, Menu, Healthy,Financial Reports, Mintel, Costs, Quality, Pizza, Taste, Flavor, Technology, Sustainability, Demographic,Hispanic

CHICAGO—The U.S. restaurant industry can expect a 5.9% increase in sales in 2014, from $438 billion in 2013, spurred by five trends to hit food service in the coming year, according to Mintel.

The trends, identified by Julia Gallo-Torres, category manager, U.S. foodservice reports at Mintel, predict:

1. Fast Casual Pulls Ahead—The impressive growth of the fast casual segment demonstrates consumers, who are still focused on price, are willing to pay more for foods they consider to be of better quality or healthier. A slew of new concepts focusing on customization, speed of service and convenience, have sprouted. These include higher quality burger chains; concepts more firmly focused on health and a rash of pizza restaurants that can deliver a fully-cooked, customized pizza in a matter of minutes.

2. Premium Proves Practical—Not to be left behind, full-service concepts are mimicking the winning ways of fast casual restaurants. For example, several full-service brands are testing or have launched concepts that utilize the speedier fast casual service model. This is important especially during the lunch rush, when consumers don't have the time to wait. Other tactics include launching healthier, more flavorful menu items and employing technology to speed up the dining experience.

3. Open Book Business Practices—More than ever, foodservice consumers are questioning the origin of their foods and they are demanding transparency not only in ingredient sourcing, but in general business practices, including the treatment of animals and employees. Consumers are interested in patronizing restaurants and buying brands that reflect their own values. Concepts that understand this and offer more information about their green practices or the causes they support stand to reap the rewards of increased loyalty.

4. Due Demographic Diligence—Operators have been obsessed with Millennials. It's understandable, as they are the ones most likely to dine out in almost every restaurant segment. However, other demographics also present growing opportunities:

CHICAGO—The U.S. restaurant industry can expect a 5.9% increase in sales in 2014, from $438 billion in 2013, spurred by five trends to hit food service in the coming year, according to Mintel.

The trends, identified by Julia Gallo-Torres, category manager, U.S. foodservice reports at Mintel, predict:

1. Fast Casual Pulls Ahead—The impressive growth of the fast casual segment demonstrates consumers, who are still focused on price, are willing to pay more for foods they consider to be of better quality or healthier. A slew of new concepts focusing on customization, speed of service and convenience, have sprouted. These include higher quality burger chains; concepts more firmly focused on health and a rash of pizza restaurants that can deliver a fully-cooked, customized pizza in a matter of minutes.

2. Premium Proves Practical—Not to be left behind, full-service concepts are mimicking the winning ways of fast casual restaurants. For example, several full-service brands are testing or have launched concepts that utilize the speedier fast casual service model. This is important especially during the lunch rush, when consumers don't have the time to wait. Other tactics include launching healthier, more flavorful menu items and employing technology to speed up the dining experience.

3. Open Book Business Practices—More than ever, foodservice consumers are questioning the origin of their foods and they are demanding transparency not only in ingredient sourcing, but in general business practices, including the treatment of animals and employees. Consumers are interested in patronizing restaurants and buying brands that reflect their own values. Concepts that understand this and offer more information about their green practices or the causes they support stand to reap the rewards of increased loyalty.

4. Due Demographic Diligence—Operators have been obsessed with Millennials. It's understandable, as they are the ones most likely to dine out in almost every restaurant segment. However, other demographics also present growing opportunities:

- Hispanics tend to dine out in larger groups and their population is increasing. Their spending power is expected to reach nearly $1.7 trillion by 2017, meaning serving this rapidly expanding community will be key to growth.

- Women visit restaurants less than men and this is likely due to their being more health- and budget-conscious. This indicates restaurants need to do more in terms of pricing, atmosphere and menu to gain momentum with this group.

- Baby Boomers enjoy dining out and have more disposable income than other demographics, but few marketing campaigns specifically target them.

Sources:

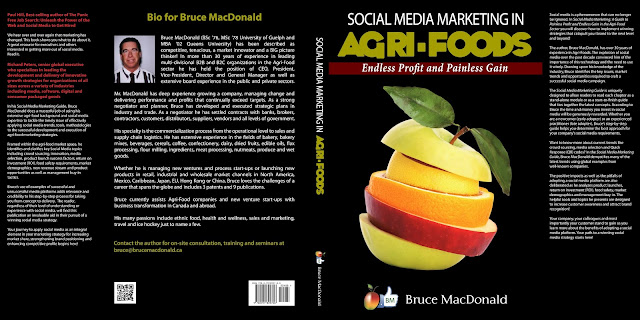

The book is available on Amazon and Kindle for $4.99 USD. Visit amazon/Kindle to order now:

http://www.amazon.ca/Social-Media-Marketing-Agri-Foods-ebook/dp/B00C42OB3E/ref=sr_1_1?s=digital-text&ie=UTF8&qid=1364756966&sr=1-1

Thanks for taking the time