E-COMMERCE: LOYALTY DRIVEN MOBILE PAYMENT OPTIONS

The mobile landscape has rapidly changed in the last three years to the point

that m-payments are not just for first adopters of technology. Euromonitor

estimates 80% of all mobile phones sold in the US and 59% of those sold

globally will be smartphones in 2014. This development means it is more

feasible for other merchants to launch successful m-payments platforms.

Such apps would be most embraced in environments that consumers frequent

weekly, if not daily. One possibility would be fast food chains. In fact, the

world’s largest fast food chain, McDonald’s, has mobile initiatives underway in

multiple markets, including Canada, France, the UK and the US. The Starbucks’

example drives home the importance of knowing the market in which your

company operates, as well as the unique qualities of your customer profile.

Telecom-led mobile platform Isis is in the initial days of nationwide deployment

in the US, but early results have shown greater adoption for those that signed

up for the attached loyalty programmes. Isis, the joint venture between

T-Mobile, AT&T and Verizon, enables users to make payments, collect points

and redeem coupons using NFC-based smartphones at POS terminals. Isis

began with a yearlong trial in Salt Lake City and Austin in October 2012 and

now has 10,000 locations where consumers can tap and pay.

These trials have indicated Isis users tap their device to pay for goods 10 times

per month on average. Most interestingly, those that signed up for loyalty

schemes were found to tap their devices nearly twice as often as those that did

not. Two-thirds of users had opted to receive offers and messages from the

participating brands with the average user following seven brands. Some of

the first merchants to have adopted Isis have gone so far as to say the loyalty

and data opportunities the wallet provided were of far greater value to them

than the mobile payment capabilities. Maverik, a gas station and convenience

This white paper contained just a glimpse of the content and analysis available

from Euromonitor International. Information for this white paper was derived

from the report The Mobile Wallet: How Loyalty Could Spur Consumer

Adoption of Mobile Payments, examining the potential for loyalty to drive

mobile payments, which is available on Euromonitor’s website.

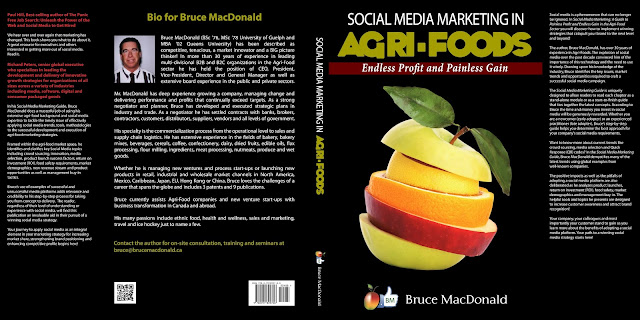

The book is available on Amazon and Kindle for $4.99 USD. Visit amazon/Kindle to order now:

http://www.amazon.ca/Social-Media-Marketing-Agri-Foods-ebook/dp/B00C42OB3E/ref=sr_1_1?s=digital-text&ie=UTF8&qid=1364756966&sr=1-1

Thanks for taking the time

The mobile landscape has rapidly changed in the last three years to the point

that m-payments are not just for first adopters of technology. Euromonitor

estimates 80% of all mobile phones sold in the US and 59% of those sold

globally will be smartphones in 2014. This development means it is more

feasible for other merchants to launch successful m-payments platforms.

Such apps would be most embraced in environments that consumers frequent

weekly, if not daily. One possibility would be fast food chains. In fact, the

world’s largest fast food chain, McDonald’s, has mobile initiatives underway in

multiple markets, including Canada, France, the UK and the US. The Starbucks’

example drives home the importance of knowing the market in which your

company operates, as well as the unique qualities of your customer profile.

Telecom-led mobile platform Isis is in the initial days of nationwide deployment

in the US, but early results have shown greater adoption for those that signed

up for the attached loyalty programmes. Isis, the joint venture between

T-Mobile, AT&T and Verizon, enables users to make payments, collect points

and redeem coupons using NFC-based smartphones at POS terminals. Isis

began with a yearlong trial in Salt Lake City and Austin in October 2012 and

now has 10,000 locations where consumers can tap and pay.

These trials have indicated Isis users tap their device to pay for goods 10 times

per month on average. Most interestingly, those that signed up for loyalty

schemes were found to tap their devices nearly twice as often as those that did

not. Two-thirds of users had opted to receive offers and messages from the

participating brands with the average user following seven brands. Some of

the first merchants to have adopted Isis have gone so far as to say the loyalty

and data opportunities the wallet provided were of far greater value to them

than the mobile payment capabilities. Maverik, a gas station and convenience

Here’s a quick look at the way some new technologies are driving loyalty into

payments:

Mobile POS devices:

• Makes it possible for business to accept payments and track loyalty —

perhaps for the first time

• These products first became popular with small businesses that might

have found establishing a merchant account through the traditional card

network daunting, if not impossible

• Now the technology is making inroads in larger stores that find value in

the enhanced consumer interaction

Mobile banking apps:

• Banks are also seeing the potential of the mobile channel to drive

consumer loyalty

• Such apps condition consumers to use and trust their mobile phone to

execute financial transactions

• Mobile banking apps could be the precursor to an issuer-led mobile wallet

Digital wallets:

• Digital wallets, such as Google’s Instant Buy, Visa’s V.me and

MasterCard’s MasterPass, store a consumer’s payment information in

the cloud or on a remote secure server in order to reduce the steps to

purchase

• The one-click functionality that digital wallets enable reduces the friction

at the checkout for mobile purchases

from Euromonitor International. Information for this white paper was derived

from the report The Mobile Wallet: How Loyalty Could Spur Consumer

Adoption of Mobile Payments, examining the potential for loyalty to drive

mobile payments, which is available on Euromonitor’s website.

The book is available on Amazon and Kindle for $4.99 USD. Visit amazon/Kindle to order now:

http://www.amazon.ca/Social-Media-Marketing-Agri-Foods-ebook/dp/B00C42OB3E/ref=sr_1_1?s=digital-text&ie=UTF8&qid=1364756966&sr=1-1

Thanks for taking the time

No comments:

Post a Comment