E-COMMERCE: LOYALTY DRIVEN MOBILE PAYMENT PROSPECTS

Practically no one disputes the potential for mobile phones to fundamentally

change the way consumers shop and pay. The real debate is the trajectory at

which this emerging payment type could become ubiquitous. Although both

emerging and developed market consumers are using mobile phones to execute

payments, m-commerce is not projected to be commonplace anytime soon.

Adoption of mobile payment apps will be directly related to the value add that

consumers receive from using mobile phones in lieu of leather wallets. Loyalty

has been shown to be an important factor driving consumer payment choice

before and will be in the mobile payment revolution as well. The loyalty that will

drive mobile payment adoption, however, will be about more than simply points

or miles or free hotel nights. Moving forward, loyalty driven mobile payment

initiatives will be about one-to-one customer engagement and the individual

consumer experience that today’s shopper want and expect.

Loyalty needs to be reimagined

One of the biggest reasons for the slow uptake of mobile wallets has been that

consumers have not yet been given a compelling reason to adopt. An embedded

loyalty scheme could be that reason, but it is important to note that loyalty

is evolving, and moving forward it will be about more than miles and points.

For years, companies thrived by using mass marketing, but such offers have

become less relevant for today’s consumers. It has progressed to the point that

consumers sign up for loyalty programmes they either do not care about or will

never redeem loyalty benefits they have earned.

Mobile wallets have failed to take off in the marketplace due to a combination

of factors, including consumer fears around privacy and security, an

uninformed consumer base, an absence of the needed infrastructure and the

convenience of already established payment methods. Ultimately, mobile

payments must be as cheap, safe and easy to use as traditional payment

methods to even be considered a viable option because consumers will choose

the method of payment that provides the greatest value. In order to encourage

wider adoption and ensure high usage, mobile payment players will have to

provide a value add, which could come in many forms, including monetary

savings, improved security, ease of use or increased loyalty. Of all these

potential benefits, mobile-driven loyalty may be the greatest factor with the

potential to drive consumer adoption of mobile payments.

Although still very much in the early days, the integration of mobile wallets

with value-added services has become almost a prerequisite for the success

of any mobile payment app, especially in more developed markets. One

of the more successful mobile wallets to date comes from the coffeehouse

giant, Starbucks Corp, which integrates its popular rewards program with

its prefunded QR-code based mobile app. In fact, a third of Starbuck’s North

American sales are funded by one of the company’s pre-paid cards, with the

mobile app itself processing 10% of those transactions.

Another real-world example of a loyalty driven mobile payment app is the

telecom-led mobile platform Isis. Although still in the early days of nationwide

deployment in the US, early results have shown greater adoption for those that

signed up for the attached loyalty programmes. It is likely that the payments

industry will see more of these loyalty driven mobile apps in the near future.

Loyalty, which has shown to be an important factor in driving consumer

payment choice in the past when it comes to card payments, will be just as an

important in the mobile revolution. The future consumer adoption of mobile

payments is directly related to this type of value add that consumers receive

from using their mobile phone. Although an embedded loyalty scheme could

provide a compelling reason to try mobile payments, it is important to note

that loyalty as we know it is in need of reinvention. Thanks to the increased

availability of smartphones, the rise of location-based technologies and the

emergence of big data, it is now feasible for companies to deliver a more

personalized loyalty offering than has ever been possible and to do so in real

time. Ultimately, mobile payments will be as much about the exchange of

payments as it is the consumer relationship around the payment transaction.

As the payments landscape continues to evolve and becomes increasingly

more crowded due to the arrival of payment entrants, especially in the mobile

payments segment, it will be that much more important for payment providers

to develop customer-centric offerings that promote loyalty, retention and

ultimately payment spend. Loyalty driven mobile payments products could be

that answer. It’s now more important than ever before for companies to set

themselves apart from competitors. To do so, companies need to have a solid

grasp of where the industry is headed. This is why market research should be a

vital component of any strategic decision.

This white paper contained just a glimpse of the content and analysis available

from Euromonitor International. Information for this white paper was derived

from the report The Mobile Wallet: How Loyalty Could Spur Consumer

Adoption of Mobile Payments, examining the potential for loyalty to drive

mobile payments, which is available on Euromonitor’s website.

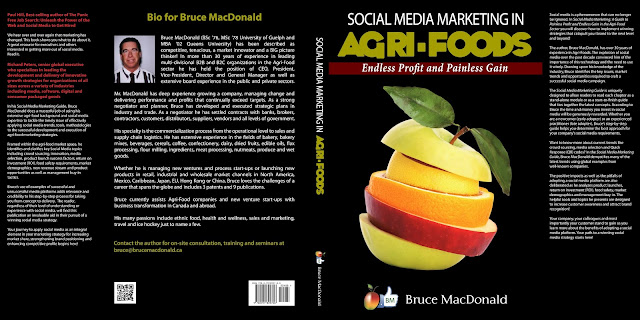

The book is available on Amazon and Kindle for $4.99 USD. Visit amazon/Kindle to order now:

http://www.amazon.ca/Social-Media-Marketing-Agri-Foods-ebook/dp/B00C42OB3E/ref=sr_1_1?s=digital-text&ie=UTF8&qid=1364756966&sr=1-1

Thanks for taking the time

Practically no one disputes the potential for mobile phones to fundamentally

change the way consumers shop and pay. The real debate is the trajectory at

which this emerging payment type could become ubiquitous. Although both

emerging and developed market consumers are using mobile phones to execute

payments, m-commerce is not projected to be commonplace anytime soon.

Adoption of mobile payment apps will be directly related to the value add that

consumers receive from using mobile phones in lieu of leather wallets. Loyalty

has been shown to be an important factor driving consumer payment choice

before and will be in the mobile payment revolution as well. The loyalty that will

drive mobile payment adoption, however, will be about more than simply points

or miles or free hotel nights. Moving forward, loyalty driven mobile payment

initiatives will be about one-to-one customer engagement and the individual

consumer experience that today’s shopper want and expect.

Loyalty needs to be reimagined

One of the biggest reasons for the slow uptake of mobile wallets has been that

consumers have not yet been given a compelling reason to adopt. An embedded

loyalty scheme could be that reason, but it is important to note that loyalty

is evolving, and moving forward it will be about more than miles and points.

For years, companies thrived by using mass marketing, but such offers have

become less relevant for today’s consumers. It has progressed to the point that

consumers sign up for loyalty programmes they either do not care about or will

never redeem loyalty benefits they have earned.

Mobile wallets have failed to take off in the marketplace due to a combination

of factors, including consumer fears around privacy and security, an

uninformed consumer base, an absence of the needed infrastructure and the

convenience of already established payment methods. Ultimately, mobile

payments must be as cheap, safe and easy to use as traditional payment

methods to even be considered a viable option because consumers will choose

the method of payment that provides the greatest value. In order to encourage

wider adoption and ensure high usage, mobile payment players will have to

provide a value add, which could come in many forms, including monetary

savings, improved security, ease of use or increased loyalty. Of all these

potential benefits, mobile-driven loyalty may be the greatest factor with the

potential to drive consumer adoption of mobile payments.

Although still very much in the early days, the integration of mobile wallets

with value-added services has become almost a prerequisite for the success

of any mobile payment app, especially in more developed markets. One

of the more successful mobile wallets to date comes from the coffeehouse

giant, Starbucks Corp, which integrates its popular rewards program with

its prefunded QR-code based mobile app. In fact, a third of Starbuck’s North

American sales are funded by one of the company’s pre-paid cards, with the

mobile app itself processing 10% of those transactions.

Another real-world example of a loyalty driven mobile payment app is the

telecom-led mobile platform Isis. Although still in the early days of nationwide

deployment in the US, early results have shown greater adoption for those that

signed up for the attached loyalty programmes. It is likely that the payments

industry will see more of these loyalty driven mobile apps in the near future.

Loyalty, which has shown to be an important factor in driving consumer

payment choice in the past when it comes to card payments, will be just as an

important in the mobile revolution. The future consumer adoption of mobile

payments is directly related to this type of value add that consumers receive

from using their mobile phone. Although an embedded loyalty scheme could

provide a compelling reason to try mobile payments, it is important to note

that loyalty as we know it is in need of reinvention. Thanks to the increased

availability of smartphones, the rise of location-based technologies and the

emergence of big data, it is now feasible for companies to deliver a more

personalized loyalty offering than has ever been possible and to do so in real

time. Ultimately, mobile payments will be as much about the exchange of

payments as it is the consumer relationship around the payment transaction.

As the payments landscape continues to evolve and becomes increasingly

more crowded due to the arrival of payment entrants, especially in the mobile

payments segment, it will be that much more important for payment providers

to develop customer-centric offerings that promote loyalty, retention and

ultimately payment spend. Loyalty driven mobile payments products could be

that answer. It’s now more important than ever before for companies to set

themselves apart from competitors. To do so, companies need to have a solid

grasp of where the industry is headed. This is why market research should be a

vital component of any strategic decision.

This white paper contained just a glimpse of the content and analysis available

from Euromonitor International. Information for this white paper was derived

from the report The Mobile Wallet: How Loyalty Could Spur Consumer

Adoption of Mobile Payments, examining the potential for loyalty to drive

mobile payments, which is available on Euromonitor’s website.

The book is available on Amazon and Kindle for $4.99 USD. Visit amazon/Kindle to order now:

http://www.amazon.ca/Social-Media-Marketing-Agri-Foods-ebook/dp/B00C42OB3E/ref=sr_1_1?s=digital-text&ie=UTF8&qid=1364756966&sr=1-1

Thanks for taking the time

No comments:

Post a Comment