Export success to our neighbour to the south demands more than entrepreneurial flair.

Export success to our neighbour to the south demands more than entrepreneurial flair. Financing is a key strategic piece, says HSBC’s Head of Global Trade and Receivables Finance Canada, who offers tactics for success.

Ben Arber visited a small Canadian commodity trading house recently to offer advice on how it might expand sales in the U.S. “A couple of phone calls later, and they’re now doing a lot more cross-border business than domestic business,” says Mr. Arber, head of Global Trade and Receivables Finance at HSBC Bank Canada.

That commodity trader’s success is a lesson for other Canadian exporters. Even as they are being urged to broaden their horizons in the fast-growing emerging economies of Asia, Eastern Europe and Latin America, it would be wise not to neglect the huge market on their doorstep.

“The post-financial crisis message for Canadian exporters has been: The days of a cheap Canadian dollar and thus plentiful orders from the U.S. are over,” Mr. Arber notes. “But the fact remains that with 73 per cent of Canadian exports still going to the U.S. and over 60 per cent of imports coming from the U.S., the U.S. is Canada’s major trading partner. As a result, I think it needs to be the priority for companies looking for opportunities to sell more and to build resilience into their supply chains.”

Two-way trade totaled $612-billion in 2012. In other terms, about $1.5-billion worth of goods and services – as well as 400,000 people – cross the border every day. According to the federal government, 38 of the U.S.’s 50 states count Canada as their number one export market, and more than 8 million U.S. jobs depend on trade and investment with Canada.

The U.S. is not only Canada’s biggest trading partner by far, it is also once again a growing market, in contrast to many others. According to Statistics Canada numbers, Canada’s exports to the U.S. were 7.9 per cent higher in July than a year earlier, easily outstripping the 4.3 per cent advance in total exports. (By contrast, shipments to the European Union, Japan, and other advanced and emerging economies that are members of the Organization of Economic Cooperation and Development all fell.) Similarly, imports from the U.S. climbed by 4 per cent in the year to July, compared to a slight drop in the total.

The spotlight in Canada-U.S. trade relations typically falls on the most prominent players. Canada ships more oil to the U.S. than Saudi Arabia and Venezuela combined, and fills 10 per cent of the U.S.’s natural gas needs. Sawmills and other forest-products suppliers are big players in the U.S. housing and paper markets. Car assembly plants and auto-parts makers, mostly in Ontario, are an integral part of carmakers’ North American supply chains.

The varying fortunes of these high-profile sectors all too often colour the public view of Canada-U.S. trade relations. Much of their experience in recent years has been less than encouraging: the fierce debate over the proposed Keystone XL pipeline from the Alberta oil sands to the Gulf of Mexico, a long-running dispute over the pricing of Canadian softwood lumber exports, long line-ups at the border, the battle to build a new bridge between Windsor and Detroit and so on.

But these tensions by no means tell the full story. For the vast majority of Canadian exporters, the challenges of doing business south of the border are dwarfed by the rewards.

The currency exchange

Mr. Arber sees especially lucrative openings for small and mid-sized manufacturers with annual revenues up to $200-million. “I find there’s a big bedrock of Canadian traders who are very innovative in terms of their world approach, and who have developed leading positions in everything from branded duvet covers and towels to generic cough medicines, stereo equipment and the garment industry in Quebec,” he says. “You’ve got a huge swath of these kinds of companies across Canada.”

Even so, export success demands more than entrepreneurial flair in designing, making and marketing a product. Many Canadian companies pay too little attention to another critical factor in winning orders in the U.S. - financing.

Price is just one element in putting together a competitive bid. Buyers – especially big U.S. retailers – can often be swayed by attractive payment terms, allowing them to delay payment for, say, 180 days rather than the normal 45.

“Getting paid in 180 days is a cost to the supplier,” Mr. Arber says, “but if it’s that cost compared to dropping the price by 10 per cent, actually it’s a nice negotiation and a nice pitch. Maybe you’re giving something that the buyer hasn’t thought about, rather than just a cheaper price.”

Chains like Wal-Mart Stores Inc., Costco Wholesale Corp. and The Home Depot Inc. have become more receptive to Canadian suppliers over the past decade as they have expanded north of the border.

But, Mr. Arber cautions, “you’ve got big procurement departments with professional hard-nosed negotiators working with Canadian suppliers trying to get the better deal and trying to look at innovative financing solutions right through the supply chain. I think it’s the knowledge of that environment in dealing with a U.S. company that is the key.”

Many Canadian companies still use bank overdrafts to finance their export business. Mr. Arber says they should also consider more imaginative and often less costly alternatives such as pre-shipment finance and off-balance sheet techniques, such as invoice discounting, factoring and forfait financing.

Pre-shipment loans, sometimes provided in conjunction with an Export Development Canada (EDC) guarantee, enable exporters to fund the purchase of raw materials and other input costs incurred prior to shipment. The financing can be tailored to meet an exporter’s cash flow and working capital needs.

Under traditional financing methods, a business can typically borrow only 50 per cent of the value of these supplies. “What we try and do,” Mr. Arber says, “is look at things like pre-shipment finance and import lending, which means we can finance up to 100 per cent of what the company is buying, and we can finance it earlier when a purchase order is issued, rather than wait until there’s stock actually sitting in a warehouse.

“So companies can get more funds earlier in their production cycle, which means they can manufacture more to fulfill orders that they might otherwise have to turn away.”

Factoring and forfait financing have the advantage of converting receivables and invoices into cash without the uncertainties that are often part of an export business.

Factoring (the purchase of an exporter’s receivables) ensures payment on a fixed date. Its advantages include certainty that operating capital requirements will be covered, and protection against a customer’s financial difficulties.

Similarly, forfaiting (the non-recourse discounting of bank-guaranteed promissory notes, letters of credit and similar debt instruments) also enables exporters to offer financing to customers yet receive immediate cash payment for the sale.

These techniques often provide more value than an overdraft, Mr. Arber notes. “When I talk to these companies and I say ‘You can get more funds, earlier and at a lower cost’, they say: ‘Where’s the catch?’ And I have to say: ‘There is no catch.’ This is how we’ve done business in Asia and the Middle East and Europe for decades.”

“If the bank is financing you … that gives confidence that you’re going to get paid. You can therefore do more business with U.S. buyers such as the big-box stores.”

However, even the smartest financing deals cannot overcome the border delays and red tape that can be a challenge for cross-border trade. Progress towards smoother border security and customs procedures has so far been slower than expected.

“I see and feel the frustration on a regular basis,” Mr. Arber says. He advises prospective exporters that border hassles are “a fact of doing business with the U.S. at the moment, and the costs should be added into any calculation.”

The silver lining is that Ottawa and Washington have recently launched an array of initiatives aimed at overcoming the problems. They include improved border infrastructure, a single channel for electronic submission of all the data required for cross-border shipments and substantial progress towards construction of the Windsor-Detroit crossing.

“The main goal is to make it easier for Canadian and American firms to do business on both sides of our shared border, leading to more jobs and growth in both Canada and the U.S.,” Prime Minister Stephen Harper said when the two governments unveiled a new “border vision” plan in 2011.

The road to recovery

On a more encouraging note, the economic climate for Canadian exporters in the U.S. is much warmer now than a few years ago. While the economy as a whole has yet to regain its pre-recession momentum, some sectors of special interest to Canadian suppliers – notably housing and automobiles – are in the throes of a steady recovery. According to industry source Autodata, Americans are expected to buy more than 15 million cars and light trucks this year, up from 14.5 million in 2012 and certainly more than the 10 million they purchased in the depths of the recession in 2009. Sales of existing homes reached their highest level in August since 2007, the National Association of Realtors in the U.S. recorded.

The International Monetary Fund projects that the U.S. economy will expand by 1.7 per cent this year and 2.7 per cent in 2014, well above the average for the big industrialized countries. “Private demand should remain solid, given rising household wealth owing to the housing recovery and still supportive financial conditions,” the IMF said in its latest forecast.

Mr. Arber adds, “We should see some relatively positive growth numbers in 2014. We believe in the U.S. economy long-term, we believe in the rejuvenation of North American manufacturing, we see energy independence for the U.S., and as a result we see the U.S. dollar continuing to be the world’s reserve currency long term.”

Indeed, a slide in the Canadian dollar over the past year has given exporters an extra competitive edge. But Mr. Arber cautions that exporters would be unwise to count on a further weakening.

“Our message to our clients and other companies is: Don’t bank either way on a massive devaluing or strengthening of the Canadian dollar. Protect yourself against downside risk.”

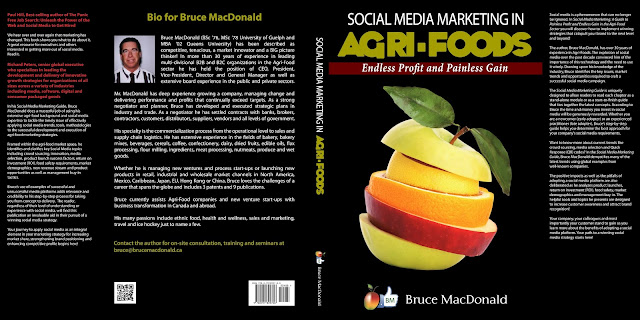

Check out my new e-book entitled: "Social Media Marketing in Agri-Foods: Endless Profit and Painless Gain"

The book is available on Amazon and Kindle for $4.99 USD. Visit amazon/Kindle to order now:

http://www.amazon.ca/Social-Media-Marketing-Agri-Foods-ebook/dp/B00C42OB3E/ref=sr_1_1?s=digital-text&ie=UTF8&qid=1364756966&sr=1-1

Thanks for taking the time

No comments:

Post a Comment