McDonald’s mulls slashing bloated U.S. menu amidst heightened competition

Jin Lee/BloombergEven as McDonald’s cuts items, it keeps adding new ones, including egg-white McMuffin sandwiches, three varieties of chicken McWraps and three new Quarter Pounders.

The Angus burger is going away, and it may not be the only McDonald’s dish on the chopping block.

The world’s largest restaurant chain has also considered axing Caesar salads, the McSkillet Burrito, the Southern Style Biscuit and steak bagels, according to a franchisee e-mail obtained by Bloomberg News. While the Angus burger contains as many as 820 calories and costs US$4, the culling isn’t simply about offering healthier fare and cheaper items. It’s an effort by McDonald’s Corp. to streamline a menu that has expanded by 70% to about 145 items since 2007 — straining kitchen staff, gumming up service and spoiling customers for choice.

“It’s gotten to the point where the operation has kind of broken down and that’s all a symptom of the complication of the menu,” said Richard Adams, a San Diego-based restaurant franchisee consultant and former McDonald’s store owner. “They can’t make the food fast enough.”

In October, some McDonald’s franchisees received an e-mail from a regional representative proposing “core menu changes” based on information from customer complaints.

Teams had been formed to address menu size and understand “what’s getting in the way of quality and service,” according to the e-mail. Seven menu items were identified for potential removal. So far Fruit & Walnut salads, Chicken Selects and Angus burgers have been eliminated.

“We are constantly adding and removing menu items,” Danya Proud, a McDonald’s spokeswoman, said in an e-mail. “It’s not new for McDonald’s. We’ve been doing it for decades!” She declined to comment on the e-mail.

Sales Challenge

McDonald’s Chief Executive Officer Don Thompson is trying to revive U.S. same-store sales, which dropped 1.2% in the first quarter. The picture improved in April, when sales at stores open at least 13 months rose 0.7%. McDonald’s shares have gained 11% in the last 12 months through Thursday, while the Standard & Poor’s 500 Index has jumped 25%. The shares rose 0.1% to US$101.22 at 9:53 a.m. in New York.

The shares have recently become less valuable to investors. They’re trading at a 16% premium to the S&P 500 Index on a price-to-earnings basis. They were trading at a 25% premium on April 18, the day before the Oak Brook, Illinois- based company reported that first-quarter net income, at US$1.27-billion on US$6.61-billion in revenue, was little changed from the previous year.

Cutting the menu down to size is a challenge for McDonald’s in part because U.S. fast-food chains are engaged in an arms race as they compete to attract diners. Even as McDonald’s cuts items, it keeps adding new ones, including egg-white McMuffin sandwiches, three varieties of chicken McWraps and three new Quarter Pounders. Burger King Worldwide Inc. in March started selling turkey and veggie burgers, while Wendy’s Co. rolled out flatbread grilled-chicken sandwiches.

Barbecue Joint

The first McDonald’s, a barbecue joint with carhop service, opened in 1940. Eight years later, the chain pared its menu to nine items, including burgers, cheeseburgers, soft drinks, milk, coffee, potato chips and pie. Over the years, the menu grew as competition heated up with Burger King and Wendy’s. The Filet-O-Fish arrived in 1963, followed by the Big Mac in 1968 and the Egg McMuffin in 1975. Along the way, pizza, spaghetti and the Arch Deluxe burger came and went.

The menu started getting more complex in the late 1990s after then-CEO Jack Greenberg pushed stores to convert to the Made-For-You ordering system, which required McDonald’s to make its food fresh instead of cooking it ahead of time. The innovation allowed the company to move beyond traditional burgers and fries.

Increasing Complexity

McDonald’s has tacked on about 60 items since 2007 and now sells 145, according to data from menu researcher Datassential in Los Angeles. The increasing complexity has slowed service at a chain that has come to define fast food.

While McDonald’s, which has about 14,100 U.S. locations, is trying out a new ordering system and adding double-lane drive-throughs to speed its service, the efforts may not be enough as some of the new items take a long time to make.

McWraps, which come in three flavours including sweet-chili chicken, take about 60 seconds to make, according to Adams, the restaurant franchisee consultant.

“That’s a very labour-intensive thing,” he said.

Fast-food chains compete fiercely to provide the fastest drive-through service. It takes longer to get through the McDonald’s drive-through than it used to, according to a study by QSR Magazine and Insula Research Inc. in Columbus, Ohio.

Drive-Through Slowdown

On average, it took almost 189 seconds for customers to get in and out of the drive-through last year, compared with 184 seconds in 2011 and about 167 seconds in 2007. Wendy’s and Taco Bell are faster, with average times respectively of about 130 seconds and 150 seconds in 2012. Burger King is slower, with a drive-through time of 201 seconds, the data show.

A comprehensive menu isn’t all that important to fast-food patrons, according to a study from Nation’s Restaurant News and consultant WD Partners published last year. Survey respondents ranked menu variety below food quality, cleanliness, value and service in terms of important attributes for limited-service restaurants. The study’s top-ranked fast-food hamburger chain, In-N-Out Burger, features one of the least complex menus.

Chipotle Mexican Grill Inc. has thrived with a minimalist menu — revenue rose 20% last year, compared with 2.1% at McDonald’s. The Denver-based burrito chain sells just five main food items, which are customized along a service line, as well as chips and guacamole and a kids’ meal.

“Part of the reason why Chipotle works so well is that it’s simple,” said Peter Saleh, a New York-based analyst at Telsey Advisory Group. “If they added four more items, it would screw up the entire process.”

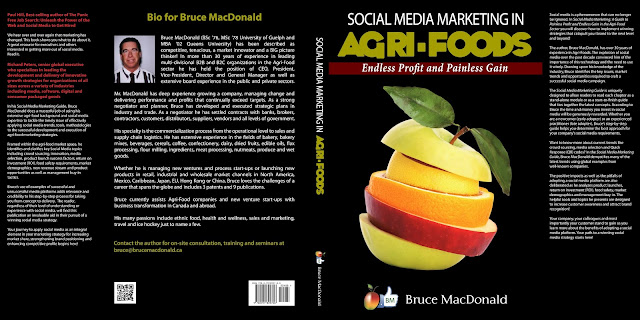

Check out my latest e-book entitled: "Social Media Marketing in Agri-Foods: Endless Profit and Painless Gain".

The book is available on Amazon and Kindle for $4.99 USD. Visit amazon/Kindle to order now:

http://www.amazon.ca/Social-Media-Marketing-Agri-Foods-ebook/dp/B00C42OB3E/ref=sr_1_1?s=digital-text&ie=UTF8&qid=1364756966&sr=1-1

Written by Bruce MacDonald, a 30 year veteran of the Agri-food industry, in "Social Media Marketing in Agri-Foods: Endless Profit and Painless Gain", Bruce applies his background and expertise in Agri-foods and social media to the latest trends, tools and methodologies needed to craft a successful on-line campaign. While the book focuses on the Agri-food market specifically, I believe that many of the points Bruce makes are equally applicable to most other industries.

No comments:

Post a Comment