You'll Never Look At Cereal Boxes The Same Again

Posted: Updated:

Print Article

The next time you stroll down the cereal aisle at a grocery store, blindfold your child. Because the characters on kids cereal boxes are literally staring at your children.

According to a recent study from Cornell University's Food and Brand Lab, cereals that are marketed to children tend to be placed on lower shelves (not so weird) and feature characters that often look downward toward children (very weird). In other words, Cap'n Crunch and his other sugar-loving friends make eye contact with kids, which in turn builds brand loyalty.

The same can't be said of adult cereal boxes, in which characters often gazed straight ahead, the researchers found.

To arrive at this conclusion, the Cornell team examined 65 different types of cereal at 10 different grocery stores, or a total of 86 cereal "spokes-characters." The team measured the angle of the character's gaze four feet away from the the shelf. Of these characters, 66 percent were targeted at kids and gazed downward.

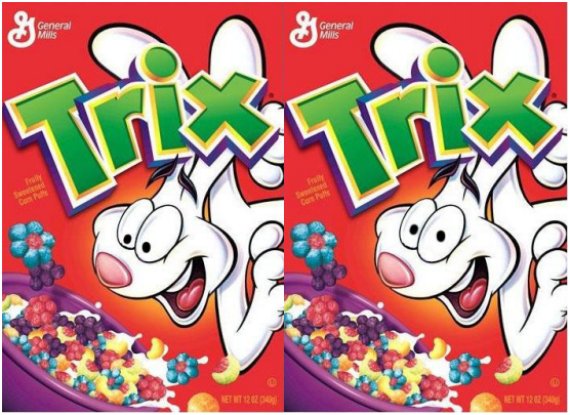

This eye contact isn't just a matter of being polite. The study found that trust for and connection to a brand are significantly increased when eye contact is established. The researchers came to that conclusion after participants viewed two versions of a Trix cereal box, one in which eye contact was made and one in which it was not. They found that when the Trix rabbit made eye contact, "brand trust" increased by 16 percent and "feeling of connection to the brand" rose 28 percent:

Tal said that in many cases, the characters on cereal boxes are actually just looking down at the cereal pictured on the box, so it's not entirely clear that the boxes are designed to deliberately seduce kids. But incidental or not, the findings are striking. Here are some examples the researchers provided of characters gazing downward:

Comparatively, this box of Wheaties, a cereal made of wheat and bran, features NBA star Kevin Garnett looking straight ahead (we found this photo ourselves):

But are cereal companies subliminally brainwashing us? It's unclear.

When contacted for comment, Kellogg's did not directly address the study, but noted that it follows industry guidelines on marketing food to children.

"Personally, I don't think it's a deliberate strategy." Aner Tal, a post-doctoral research associate at Cornell, told The Huffington Post on Wednesday. "I think it's incidental... But the finding could be used for good."

One way? The findings could help companies market healthier cereals to younger kids, Tal suggested. For now, Tal recommends some basic advice for those who want to make conscious, smart decisions at the grocery story: "Stick to the shopping list."

Here are some other good examples we found of cereal characters looking down: